For the past few weeks I have been exploring the DeFi space,I also joined the DeFi talents program by the Frankfurt school Blockchain center and it has been an amazing experience. The DeFi technology has been the talk of the financial and tech space for a while. This article will delve into the core concepts and architecture of the DeFi ecosystem.

Differences Between DeFi and TradiFi

DeFi is “the movement that promotes the use of decentralized networks and open-source software to create multiple types of financial services and products” according to the Binance Academy. DeFi is also exclusively defined as an ecosystem that provides financial services on applications (DApps) built on protocols that are public, interoperable, permissionless and decentralized. Some of the notable DeFi use cases include, StableCoins, Decentralized Exchanges, Decentralized Money Markets and Money Legos. Lets take a look at what the differences between DeFi and traditional Finance systems that we have been utilizing are:

| DeFi | TradiFi |

| DeFi does not rely on intermediaries | TradiFi is highly reliant on intermediaries such as central banks |

| DeFi transactions are open any user can audit | TradiFi transactions done by other user are not transparent to others |

| Level of IT security is lower, but can be enhanced by using (external) audits | Security is high due to regulation |

| Transactions are irreversable | Settlement finality is a requirement, but applicable rules and regulations may allow the reversibility of transactions |

Defining the DeFi stack

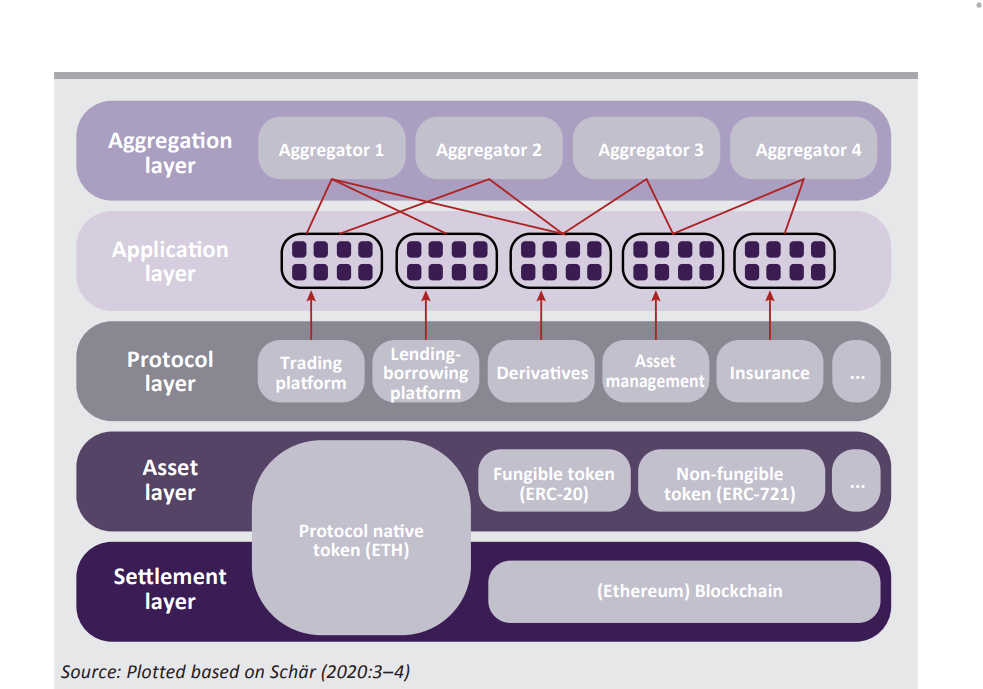

Individual protocols and applications are developed in a way that they are able to interact with each other in decentralized financial systems. The DEFI stack is composed of five layers which are interoperable with each other.

Settlement Layer

The settlement layer is the lowest layer in the DEFI stack. This is the blockchain that is being used for settlements and dispute resolution. It contains the basic operating rules of the ecosystem. Transactions are executed at this level. An example is the Ethereum Blockchain.

Asset Layer

This is the layer where the tokens run. It hosts both Fungible and Non-Fungible tokens.

Protocol Layer

This layer provides rules and regulations for different DEFI activities. This is the layer where organization build the various DEFI applications and services. These include smart contracts, Keepers and Oracles

Application Layer

This layer is where user-oriented applications that connect the protocols and standards in individual protocol layers are built. Such applications include, DEFI exchanges ,Swapping platforms and lending services.

Aggregation Layer

This layer is built on top of the application layer. It is composed of aggregators that operate by simultaneously connecting different user-centric platforms and protocols and linking relevant information from them. Thus allowing users to make sound decisions when comparing the services and costs of operating on different DEFI applications.

After examining what DEFI is and how the ecosystem is structured this article concludes that DEFI is non-custodial , permissionless, composable and openly auditable. Participants can interact with financial services without being censored by third parties and have full control of their funds. Additionally financial services can be composed such that new financial products and services are created and anyone can audit the state of the system.